Uber State Tax Id

Uber also provides its drivers with a third document known as a tax summary. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

A Guide On System Requirements Specified By Gstn For Accessing The Gst Common Portal And Usage Of The Digital Signatu Filing Taxes Income Tax Return Income Tax

It also shows selected expenses you can likely deduct on your Schedule C.

Uber state tax id. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. Some states allow anyone to search for a state tax ID number online. It is on your W2 above the Employers name in box B.

It is one of the corporates which submit 10-K filings with the SEC. Please click on this link to. The Texas Comptroller of Public Accounts for example has a sales taxpayer search page where you can find a tax ID number.

800896455 You can simply look this up at Irsgov Happy Filing. If you are an Uber driver versus getting paid by Uber with a W2 you are operating as a self-employed business and should be filing out Schedule C for both federal and PA state. Uber Technologies Inc is a corporation in San Francisco California.

Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business. The order will appear as CANCELED in the ORDER HISTORY section of your Uber Eats Orders. All businesses need a federal tax ID number except sole proprietors that are not employers and are not independent contractors.

The client must issue a 1099 form to the independent contractor and the independent contractor must. The Employer Identification Number EIN for Uber Technologies Inc is 45-2647441. You dont need an EIN to file taxes as an individual.

34 rows EINTAX ID. An independent contractor is a self employed business person that receives more than 600 per year from anyone of his or her clients. Typically you dont need Ubers EIN - you just report all of your income on your Schedule C since youre running your own business driving services.

Heres some information I received by text from Ridehare Drivers United. UPDATE ON UNEMPLOYMENT INSURANCE FOR UBERLYFT DRIVERS. This number is entered on state tax forms used to report state income taxes withheld from employees pay.

On the schedule C you declare all income received and expenses related to that income. 1 As an Uber andor Lyft driver you should be able to receive unemployment insurance. You will want to make sure your account profile name matches your legal.

1099s will be mailed as well to drivers and delivery people who opted in for a mailed copy. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters. Answer 1 of 7.

If a customer cancels an order youll receive a pop-up notification in Uber Eats Orders. Some states like Nevada dont impose an income tax on individuals. If you have employees you generally need to apply for a State Withholding Number.

Original deadline to file State tax returns or an. Verify and locate Tax IDs instantly. See FAQ page for more information on how to opt inopt out of electronic delivery.

They let your small business pay state and federal taxes. Uber will send you a 1099-K which will have your SSN on it and a copy of that will be sent to the IRS. If you have not started preparing the order.

Licenses and certificates of registration reflecting new Hawaii Tax ID numbers were mailed to taxpayers with active GE RV SC TA and UO accounts in August 2016. The employer identification number EIN for Uber Technologies Inc is 452647441. By January 31 2021.

Thats what you will. Where you will find. You can enter the business name or in the case of a sole proprietorship the owners name.

The Nevada Tax ID can be obtained online at the NevadaTax website. If its a common name you can also enter the companys ZIP. If you have questions about the online permit application process you can contact the Department of Taxation via the telephone number 800 992-0900 or by visiting the permit information website.

This includes revenue you make on Uber rides Uber Eats and any other sources of business income. The Uber tax summary isnt an official tax document. Search over millions of EINs online.

Generally businesses need an EIN. You should keep any 1099s you receive as a record in case youre audited but dont have to submit them with your taxes. View EIN for UBER.

Federal Employer Identification Numbers FEIN continue to serve as the primary identifier for CO FR and PS tax accounts. Check with your state. Its simply a form that shows your 1099-K and 1099-NEC incomes on one page.

Taxpayers should provide new Hawaii Tax ID numbers to financial institutions. Depending on the order status take note of the following. Federal Tax ID Number Search Experts.

An Employer Identification Number EIN is. A helpful tax summary. You may apply for an EIN in various ways and now you may apply online.

Commerce Duniya Claiming Relief Under Section 89 1 On Salary Arre Income Tax Return Income Tax Income Tax Return Filing

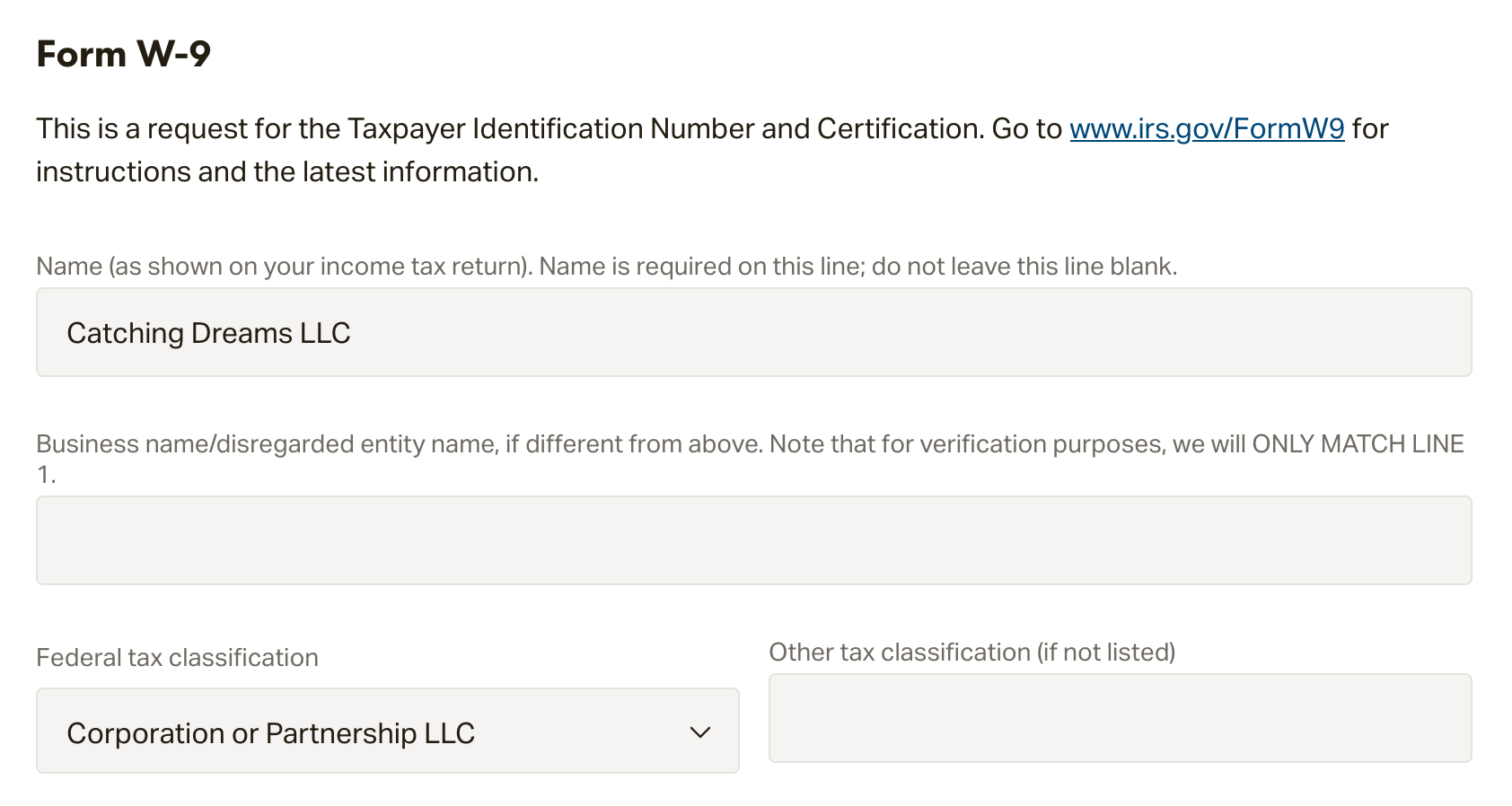

Submitting A W 9 Patreon Help Center

Taxfix Raises 65 Million For Its Mobile Tax Filing App Technews Filing Taxes Tax Refund Techcrunch

Tin Re Verification Re Submission

Hong Kong Free Press Hkfp On Twitter Uber Taxi Uber Driver Uber Cab

The Dyslexia Think Tank Legasthenie Dyskalkulie Therapie

Tax Id Theft In 2021 Conceptual Illustration Illustration Conceptual

Uber Ein 3 Important Things To Know Ridester Com

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

Driving With An Llc Or Corp How To Send Your Ein To Uber Or Lyft Ridesharing Driver

Iot Cars And Critical Infrastructure Investments Cyber Cover Image2 Cyber Security Iot Infrastructure

How Do I Find My Employer S Ein Or Tax Id

Driving With An Llc Or Corp How To Send Your Ein To Uber Or Lyft Ridesharing Driver

Uber Ein 3 Important Things To Know Ridester Com

The Difference Between Tax Id Tin And Tax Number In Germany

Gst Registration In East Delhi Ca Adda State Tax Consumption Tax Sole Proprietor

Post a Comment for "Uber State Tax Id"