How Often Do Businesses Pay Unemployment Taxes

At least one quarterly payroll totaling 1500 or more including wages for both full and part-time. Most employers qualify for a tax credit of 54 0054.

What S The Cost Of Unemployment Insurance To The Employer

Department of Labor under the Social Security Act.

How often do businesses pay unemployment taxes. The IRSInternal Revenue Service requires most small business owners to pay taxes on quarterly basis if they owe 1000 or more in taxes. The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars 10000 per employee per calendar. If you meet one of the following conditions you are an employer required to pay unemployment taxes.

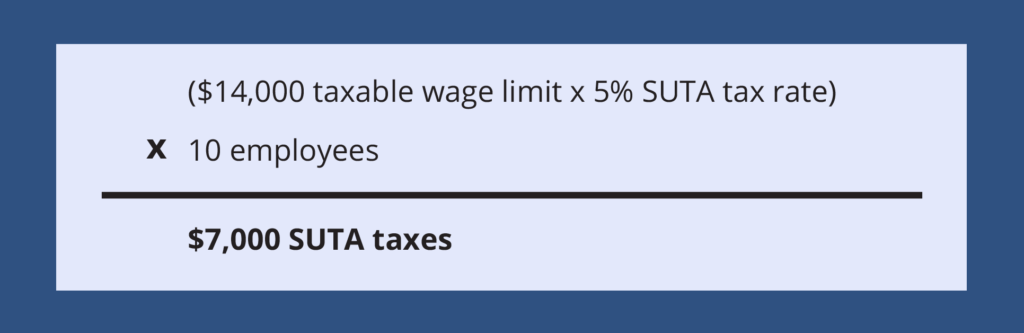

Pay wages of at least 1500 during a calendar quarter or. In general employers must pay 6 of gross wages up to a cap of 7000 per worker in order to fund federal unemployment taxes FUTA for each employee. Business should check with their local.

If you are self employed as a sole. You do not hold back the FUTA tax from an employees wages. For a list of state unemployment tax agencies visit the US.

Submitting this form will. An employer is liable to pay reemployment tax if it meets any of the following conditions. Rules for Unemployment Insurance Tax Liability.

If you paid 1500 or more to an employee your business has to pay the unemployment tax. Department of Labors Contacts for State UI Tax. Both federal and state unemployment taxes are based on employee wages.

Partnerships however file an annual information return but dont pay income. 7031 Koll Center Pkwy Pleasanton CA 94566. Most businesses must file and pay federal taxes on any income earned or received during the year.

The reports and any payment due must be filed on or. Unlike some other payroll taxes the business itself has to pay the FUTA tax. Employers must pay both federal and state unemployment taxes either quarterly or when they make their payroll contributions.

Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. Employ at least one worker. Liable employers must submit a tax report every quarter even if there are no paid employees that quarter andor taxes are unable to be.

Most employers pay both a Federal and a state unemployment tax. The FUTA tax rate is 6 006. All employers who are liable for unemployment insurance UI must file tax and wage reports for each quarter they are in business.

The Unemployment Insurance Tax program is part of a national program administered by the US. If your small business has employees working in Texas youll need to pay Texas unemployment insurance. As a for-profit employer in South Carolina you generally are liable for state UI taxes as soon as you meet any of the following conditions.

If youre like many small business owners the complications of the tax. Your business has to pay the FUTA tax. Tax reports or tax and wage reports are due quarterly.

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeping Business

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

Are Employers Responsible For Paying Unemployment Taxes

Futa Tax Overview How It Works How To Calculate

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

This Quarterly Tax Reference Guide Is For Any Business That Has Employees And Contrac In 2021 Bookkeeping Business Small Business Bookkeeping Small Business Accounting

How Much Does An Employer Pay In Payroll Taxes Examples More

What Is Meant By Payroll Tax Are Employers Actually Taxed On The Salaries They Pay Employees What Does The Term Payroll Tax Means Quora

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

This Quick Reference Guide To Business Taxes Give You A Better Understanding Of Why You Are Paying Cer Bookkeeping Business Business Tax Small Business Planner

Scope Of Management Accounting Management Guru Tax Prep Checklist Small Business Tax Tax Prep

What Does An Unemployment Claim Cost An Employer Uis

Payroll Tax Series Part 3 Unemployment Tax Filings National Peo

How To Manage 1099 Sales Reps Independent Contractors Independent Contractor Professional Insurance Bookkeeping Business

Are Employers Responsible For Paying Unemployment Taxes

Post a Comment for "How Often Do Businesses Pay Unemployment Taxes"