Uber Business Code Irs

For real estate agents brokers the code is 531210. What is the business code for an UberLyftDoorDash Driver.

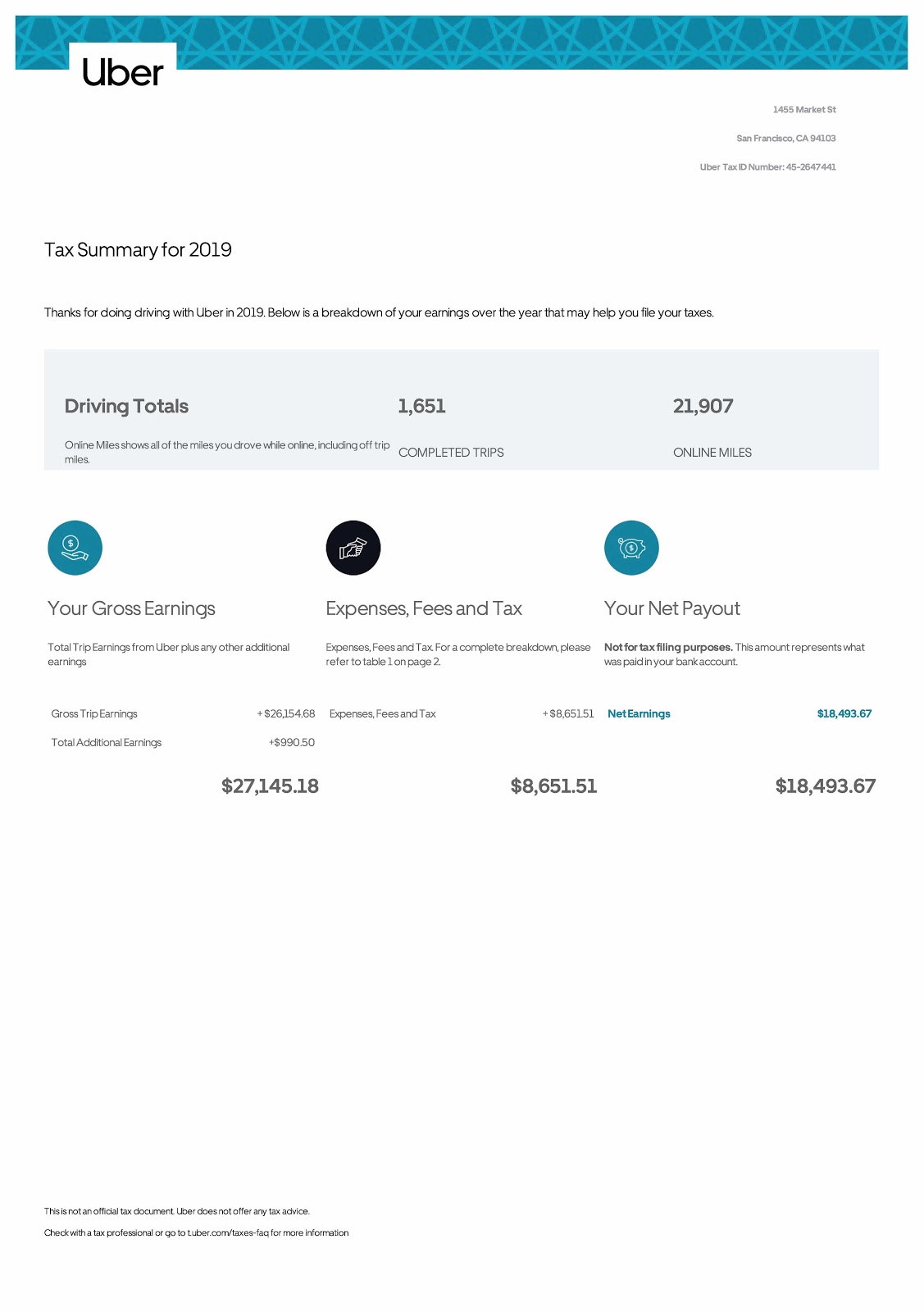

Uber Ein 3 Important Things To Know Ridester Com

Uber Lyft and other rideshare drivers are required to file IRS code 485300 Taxi Limousine Service.

Uber business code irs. For delivery drivers such as Doordash and Postmates the code is 492000 -- couriers and messengers. The IRS requires that business owners filing their different tax forms to list the appropriate code for their business. For example if the Tax Authority confirms the SBR for you on 15 January it will only start applying for you on 1 April.

The Small Business Regime will only start applying for you at the beginning of the NEXT quarterly tax period. The employeeindependent contractor issue is one that existed before Uber and it will continue long after as long as the Internal Revenue Code and state labor laws make financial distinctions between the two. Then you would go to Sandwich shops limited-service which has the code 722513.

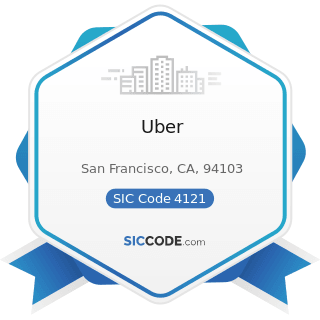

The employer identification number EIN for Uber Technologies Inc is 452647441. For example if you own a sandwich shop the first category that you would choose is the Accommodation Food Services Drinking Places category. This is where you describe your business activities.

It is one of the corporates which submit 10-K filings with the SEC. For 2018 the IRS description for business code 485300 has been updated to Taxi limousine ridesharing service That clarifies that this is the correct code for an Uber or other ridesharing driver. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters.

It is important to use correct NAIC code as the IRS computers can identify typical expense ratios for a given industry to determine Audit Risk. Schedule C NAICS code. Within a category you must find the description that best represents your business.

Sales tax paid on Uber fees. Hope this helps 0. Uber Technologies Inc 10-K filing includes an Exhibit 21 subsidiary information.

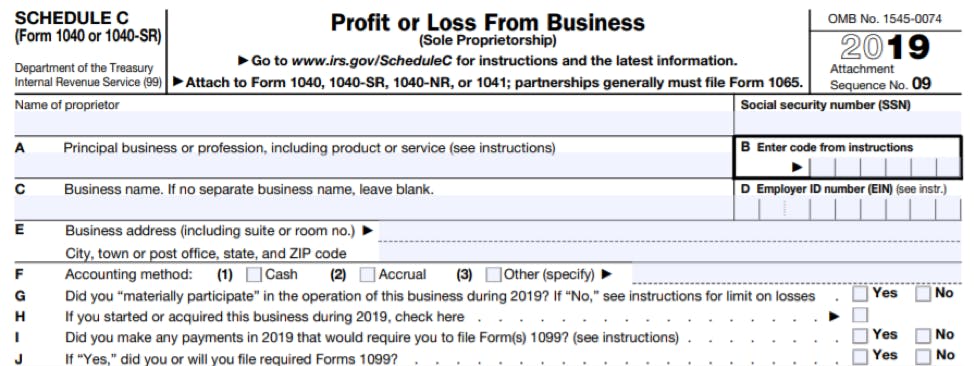

Report Inappropriate Content. Profit or Loss from Business for Contractors with Grubhub Doordash Uber Eats Instacart and others. What is the business code for an uber driver.

But if youre working in the gig economy it applies to you. Potential business expenses service fee booking fee mileage etc Well provide you with a monthly and annual Tax Summary. This is how much you earned from your delivery.

If you also drive for Uber and Lyft the code is 485300 TaxiLimo. 485990- other transit and ground transportation services. 425120 - Wholesale trade agents and brokers.

For delivery and courier drivers your tax code is 492110. This includes revenue you make on Uber rides Uber Eats and any other sources of business income. If you drive in Quebec you will only receive an annual Tax Summary in February for the previous year.

According to Dara Khosrowshahi CEO of Uber Uber accounts for less than 1 of all miles driven globallyJust a small percentage of people in countries where. The code is 485300. Business codes are used by the IRS to categorize your business for statistical purposes only.

To show whether you have a profit or loss from your business you file IRS Schedule C Profit or Loss From Business with your personal tax return. IRS Schedule C has a list of many codes grouped by industry and specific role while the North American Industry Classification System is responsible for the IRS business codes. Taxi services inheritly have high Car Truck expenses so this expense category is flagged less assuming.

Most tax filing softwares will allow you to look up your code within the. 485300 Taxi Limousine Service. The code you enter will not affect the outcome of your tax return.

The IRS code for Uber Lyft and other rideshare drivers is. On this form you list all the income you received from Uber as shown on your 1099 form. Most important is when filling out this section on Line B the six-digit business code for food deliveries businesses is 492000 Couriers Messengers.

What Is The Uber Business Code For Taxes. 425110 - Business-to-business electronic markets. Part I is for Income.

The article walks through the preparation of the T2125 for Uber drivers For example the article mentions the industry code 485990 should be used. In this case you should only tick the relevant box on your Uber Profile on 1 April not before. Privacy Policy Terms of Use Terms of Use.

If you drive for a rideshare company like Uber or Lyft youll use the same business activity code as taxi and limousine drivers. 2020 Uber Technologies Inc. Uber Business Model is also known as a Multisided Platform Business Model as it connects drivers offer and passengers demand in order to offer cheaper transportation and an additional source of income.

Code 110000 Agriculture forestry hunting and fishing 111000 Crop production Mining Code 211110 Oil and gas extraction 211120 Crude petroleum extraction 211130 Natural gas extraction 212000 Mining except oil and gas Utilities Code 221000 Utilities Construction Code 230000 Construction 236000 Construction of buildings Manufacturing Code 310000 Manufacturing. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. 561439 Other business service centers including copy shops 561450 Credit bureaus 561499 All other business support services 561500 Travel arrangement and reservation services 561520 Tour operators 561700 Services to buildings and dwellings 562000 Waste management and remediation services Code 445200 Code Code Code 443120 Computer and software stores.

Okay the title on the Schedule C doesnt list all those gig platforms. The IRS would prefer that.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

How Do I Find My Naics Code For My Ppp Loan Application Important 2021 Updates Womply

What Is A Naics Code And How Do I Find Mine Startingyourbusiness Com

Filling Out Irs Tax Form W 9 For Independent Contractors Such As Uber Or Lyft Drivers Stock Photo Alamy

Vita Rideshare Tax Information

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Form 1099 Nec For Nonemployee Compensation H R Block

Vita Rideshare Tax Information

Uber Zip 94103 Naics 485310 Sic 4121

Online Advertising Do Your 2021 Tax Return Right With Irs Vita Certified Experts For Free Uber Lyft Drivers Let Vita Irs Certified Experts Do Your 2019 Tax Return For Free

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Tax Tips For Uber Lyft And Other Car Sharing Drivers Turbotax Tax Tips Videos

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Non Car Expenses Schedule C Grubhub Doordash Postmates Uber Eats

Filing Taxes Tax Tax Deductions

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Post a Comment for "Uber Business Code Irs"