Ohio Business Gateway Withholding Account Number

1099-Rs to the Ohio Department of Taxation per Ohio Revised Code 574707 5747071 and Ohio Adminstrative Rule 5703-7-19. Ohio Department of Taxation Taxpayer Services Division PO.

Ohio Department Of Taxation S Casino Training Ppt Download

March 31 2020 TAX.

Ohio business gateway withholding account number. If you have a small number clients and do not require an automated solution then the Ohio. Employers must register their business and may apply for an employer withholding tax account number through OBG. Domestic for-profit corporations must also obtain a Certificate of Tax Clearance.

The Ohio Business Gateway is a one-stop approach where you can. Save time and money by filing taxes and other transactions with the State of Ohio online. All employers who issue 10 or more W-2s will be required to upload their W-2 information electronically through the W-21099 Upload feature on the Ohio Business Gateway.

Gateway login presented below. Deactivate your unemployment online at ericohio. The Federal ID Number with a dash is used as the account number.

Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. If you do not receive an email please verify the address provided and try again. Click the button below to be taken to the OHID login screen.

Enter a valid month. Please refer to the Ohio Business Gateway for more information. In addition to the requirements above all business entities must close their accounts with the Ohio Department of Taxation to avoid further billing and possible assessment.

Register for a vendors license. Gateway login presented below. You may also need to close use tax Commerical Activity Tax employer withholding and excise and energy tax accounts.

27 2021 online self-service will be the only way for you to recover your username or password. After reviewing the information submitted ODJFS will notify you in writing of your employer ID and contribution tax rate if. Employers must register their business and may apply for an employer withholding tax account number through OBG.

The department offers two methods to accomplish this - through the Ohio Business Gateway or by paper application. The Help Desk is available Monday through Friday from 8 am. If you need assistance with the Gateway call the Gateway Help Desk at 866-OHIO-GOV 866-644-6468 or put in a ticket online.

Companies who pay employees in Ohio must register with the OH Department of Taxation for a Withholding Account Number and the OH Dept of Job and Family Services ODJFS for an Employer Account Number. Contact the Department of Taxation. Date of birth cannot be today or in the future.

Log into ohio business gateway login page with one click find related helpful linksLast Updated 24th August 2021 Ohio Business Gateway https businessgatewayohiogov login selecting Continue you will create brand. Ohio Department of Job and Family Services Contribution Section PO Box 182404 Columbus Ohio 43218-2404. Log into ohio business gateway login page with one click find related helpful linksLast Updated 24th August 2021 Ohio Business Gateway https businessgatewayohiogov login selecting Continue you will create brand.

Be sure to use your real date of birth you may need it for account recovery later. Each option is explained below. To increase security for your business set up Online Account Recovery.

Box 182215 Columbus OH 43218. File and pay sales tax and use tax. To increase security for your business set up Online Account Recovery.

Log into the Gateway and click the profile icon and click Account Settings. For assistance with Ohio Business Gateway please call the Gateway Help Desk at 866-OHIO-GOV 866-644-6468. Employers must register their business and may apply for an employer withholding tax account number through OBG.

To recover your User ID. It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers compensation premiums and municipal income taxes for. Save time and money by filing taxes and other transactions with the State of Ohio online.

Ohio Business Gateway - Use the Ohio Business Gateway to register file. Log into the Gateway and click the profile icon and click Account Settings. January 18th is the filing deadline for IT501.

Ohio Department of Taxation Withholding Account Number. Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government. 27 2021 online self-service will be the only way for you to recover your username or password.

All employers are required to file and pay electronically through Ohio Business Gateway OBG OAC. Date of birth should be in mmddyyyy format. All employers are required to file and pay electronically through Ohio Business Gateway OBG OAC.

Last 4 digits of. Please see below for the forms required by the business tax divisions. Close an Unemployment Compensation Tax Account.

Date of birth is required. Save time and money by filing taxes and other transactions with the State of Ohio online. The Village of Lexington does accept withholding payments via the Ohio Business Gateway.

All business taxpayers must be registered with the Ohio Department of Taxation. Submitted must be registered with the Ohio Department of Taxation and have an active Ohio Employer Withholding account in order for a bulk filer to successfully. - 5 pm excluding state holidays and provides access to qualified representatives from each service partner who are authorized to assist with filing and service-related questions.

December 27th filing deadline. Taxohiogov Contact Us Online Notice Response Service or gatewayohiogov Online Notice Response Service. Please refer to the Ohio Business Gateway for more information.

To register your account by paper please complete a Report to Determine Liability JFS-20100 and mail it to. Enter a valid day. Please refer to the Ohio Business Gateway for more information.

If the email address provided matches one registered with an OHID account your username will be provided via email to that address within 5-10 minutes. All employers are required to file and pay electronically through Ohio Business Gateway OBG OAC.

Ohio Department Of Taxation S Casino Training Ppt Download

Sales And Use Tax Electronic Filing Department Of Taxation

Ohio Business Gateway Changes Modernization Rea Cpa

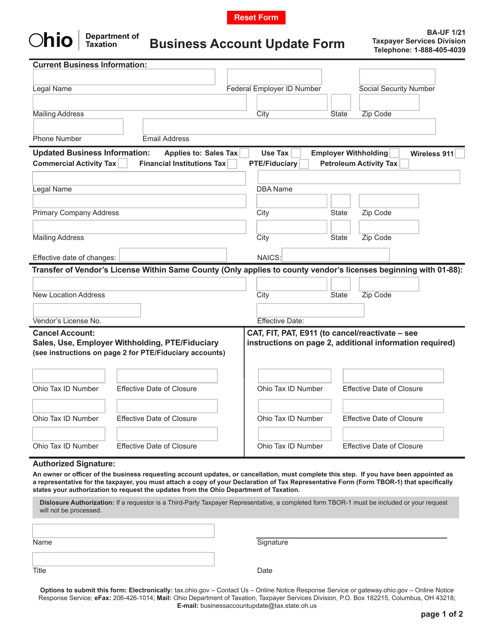

Form Ba Uf Download Fillable Pdf Or Fill Online Business Account Update Form Ohio Templateroller

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio It 501 Form Fill Out And Sign Printable Pdf Template Signnow

Businesses Department Of Taxation

What S Coming Next To The Gateway

Ohio Business Gateway Changes Modernization Rea Cpa

Ohio Business Gateway Changes Modernization Rea Cpa

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

Post a Comment for "Ohio Business Gateway Withholding Account Number"