Uber Driver Business Activity Code

For real estate agents brokers the code is 531210. Business Activity Codes The codes listed in this section are a selection from the North American Industry Classification System NAICS that should be used in completing Form 990 Part VIII lines 2 and 11.

Architecting A Safe Scalable And Server Driven Platform For Driver Preferences With Ribs Uber Engineering Blog

The right answer is Taxi Code48531.

Uber driver business activity code. Shes been working in personal and small business tax for 13 years and has been specialising in tax for Australian Uber Drivers for the last 5 years as the Director of DriveTax. Uber Business Model is also known as a Multisided Platform Business Model as it connects drivers offer and passengers demand in order to offer cheaper transportation and an additional source of income. A passenger uses a third-party digital platform such as a website or an app to request a ride for example Uber Hi Oscar Shebah or GoCatch.

Our continued success depends on building good relationships with customers shareholders and governments. Here you fill out your business income as a contractor for Grubhub Doordash Postmates Uber Eats and others. What is the business code for an uber driver For 2018 the IRS description for business code 485300 has been updated to Taxi limousine ridesharing service That clarifies that this is the correct code for an Uber or other ridesharing driver.

485300 Taxi Limousine Service. Doordash and Postmates use the 492000 code for couriers and messengers. Profit or Loss from Business for Contractors with Grubhub Doordash Uber Eats Instacart and others.

The IRS code for Uber Lyft and other rideshare drivers is. Jess Murray is a CPA Accountant and registered tax agent. Please refer to the ATOs website for GST registration guidelines.

Founded in 2009 in San Francisco Uber began its inception as a transportation company that hired experienced and licensed drivers to provide its services. About the Author Jess Murray CPA Uber Accountant. Business has been booming since although a number of.

To understand more you can contact your accountant or an Uber Pro Rewards provider for more information. Ride-sourcing sometimes referred to as ride-sharing is an ongoing arrangement where. You will use the same business activity code as taxi and limousine drivers if you are driving for a rideshare company like Uber or Lyft.

485300- taxilimo services. If you dont see a code for the activity you are trying to categorize select the appropriate code from the NAICS website at wwwcensusgov. You use the car to transport the passenger.

According to Dara Khosrowshahi CEO of Uber Uber accounts for less than 1 of all miles driven globallyJust a small percentage of people in countries where. Urban transit by definition from Stat Canada is a regular and scheduled transportation system. Basic Financial Information for your business.

11 Business Code of Conduct Uber confidential. What Business Activity Type Is Uber. A business industry code BIC is a five-digit code you include on relevant tax returns and schedules that describes your main business activity.

For delivery and courier drivers your tax code is 492110. To be registered for GST you must register for an ABN and file quarterly Business Activity Statements BAS. Business industry code tool.

The code is 485300. Uber does not buy market access business or policy outcomes with money gifts or other perks. It is important to use correct NAIC code as the IRS computers can identify typical expense ratios for a given industry to determine Audit Risk.

There is a code of 485300. But if youre working in the gig economy it applies to you. The Delivery Drivers Tax Information Series Disclaimer Schedule C.

Okay the title on the Schedule C doesnt list all those gig platforms. Over time the company began to grow dramatically and evolve owing to its ride-sharing app and adaptation of the current trending advertisement procedures. Lets do it right.

Therefore the drivers in effect must register for an Australian Business Number and GST. The EIDL grant is very different than the PPP application in that youre putting information in based on the 12 months before the event that happened. For delivery drivers such as Doordash and Postmates the code is 492000-- couriers and messengers.

Taxi services inheritly have high Car Truck expenses so this expense category is flagged less assuming your. Enter primary business activity business industry code or ANZSIC code 52991 Taxi Driver This class consists of units mainly engaged in driving taxis on behalf of owners. Guidelines To ABN Registration If you are an enterprise as termed by the Australian Tax Law or an Uber Driver who delivers ride sharing services then you need to register for an ABN and GST.

BICs are derived from the Australian and New Zealand Standard Industrial Classification ANZSIC codes and have been simplified for tax return reporting purposes. If you drive for a rideshare company like Uber or Lyft youll use the same business activity code as taxi and limousine drivers. It is incorrect.

Business codes are used by the IRS to categorize your business for statistical purposes only. You a driver make a car available for public hire for passengers. 485990- other transit and ground transportation services.

You can do so at the same time if you are doing it online. The code you enter will not affect the outcome of your tax return.

Become A Rideshare Driver In Your City Uber

Uber Eats Referral Code Eats Uber94und For More Info Uberdriverreferral Com Drive Uber Uber Driving Driving

![]()

Uber S New Driver App Identifies Areas With The Best Fares Techcrunch

How To Set Your Trip Preferences In Uber Driver 6 Steps

Service Fee Payments Made Easy Uber Blog

How To Become An Uber Or Lyft Driver Nerdwallet

Architecting A Safe Scalable And Server Driven Platform For Driver Preferences With Ribs Uber Engineering Blog

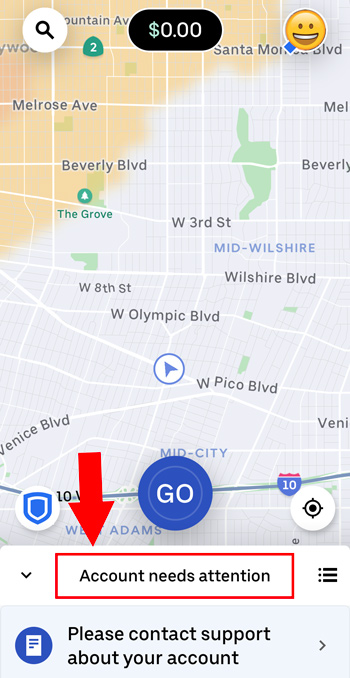

Fired From Uber Why Drivers Get Deactivated How To Get Reactivated Ridesharing Driver

Driving With An Llc Or Corp How To Send Your Ein To Uber Or Lyft Ridesharing Driver

How To Set Your Trip Preferences In Uber Driver 6 Steps

How To Set Your Trip Preferences In Uber Driver 6 Steps

How To Set Your Trip Preferences In Uber Driver 6 Steps

Uber Class Diagram Class Diagram For Uber System To Visualize The Different Classes And Relationships Of The Uber Class Diagram Diagram Programming Patterns

Uber Eats Driver Guide 2019 Apply And Get An Ubereats Sign Up Bonus Uber Driver App How To Apply Uber Driving

Kashif Khalid Why Uber Will Disappear Uber Uber Business Working For Uber

Uber Zip 94103 Naics 485310 Sic 4121

Architecting A Safe Scalable And Server Driven Platform For Driver Preferences With Ribs Uber Engineering Blog

Use Case Diagram For Uber Service The System Involves The User And The Uber Driver And How The Taxi Request Ord Use Case User Flow Diagram Computer Generation

Building A Scalable And Reliable Map Interface For Drivers Uber Engineering Blog

Post a Comment for "Uber Driver Business Activity Code"